Just like any other type of business, selling on Amazon requires understanding the intricacies of Amazon monthly payments. The importance of this factor is highlighted by data from IBN, revealing that poor cash flow is the reason why eight out of ten small businesses fail.

Without a doubt, mastering the ins and outs of Amazon payments is indeed crucial in planning your resources and growing your business.

Let’s explore the fundamentals of Amazon monthly payments and how the whole process works. Below, we’ll also offer practical tips on how to manage Amazon monthly payments to maintain a healthy cash flow for your business.

What are Amazon monthly payments?

Amazon monthly payments refer to a system that allows sellers to receive their earnings on a regular basis, ensuring a consistent flow of income.

In a traditional shop, you typically receive the business income as soon as the customer pays. In an Amazon business, however, sales are held by the system for a specified period to cover potential returns or chargebacks.

After subtracting all the fees, the funds are then disbursed to the seller’s Amazon payment account.

Here are some of the benefits of the Amazon monthly payments system:

- Consistent cash flow. Sellers can rely on regular, predictable disbursements, which makes financial planning and budgeting much easier.

- Simplified financial management. A monthly Amazon payment streamlines the process of managing finances. By knowing exactly when to expect funds, sellers can better align their cash flow with their financial obligations.

- Improved business planning. With regular income from Amazon seller payment disbursement, sellers can make informed decisions about inventory purchases, marketing investments and other expenditures.

According to data cited by Meteor Space, more than half of companies surveyed believe that they get a competitive edge from efficiently managing their supply chain.

For Amazon sellers, integrating the Amazon seller payment schedule into their financial strategy can significantly enhance their supply chain management.

Regular, predictable Amazon monthly payments allow sellers to efficiently manage their cash flow, ensuring they can maintain optimal inventory levels without the stress of financial uncertainty.

How Does Amazon Monthly Payments Work?

To help you get a deeper insight into the Amazon seller payment process, here’s a step-by-step guide to understanding how this system works.

1. Setting Up Your Payment Account

Before you can receive an Amazon payout, you need to add your bank account and a valid credit card to Seller Central.

One crucial thing to remember is to ensure that your bank account supports Automated Clearing House (ACH) transactions. A proper payment integration setup will allow Amazon to disburse payments directly to your account.

A beginning balance refers to the initial amount of money available in a seller’s Amazon payment account at the start of a new payout period. This balance includes all the funds from previous sales that have cleared any holding periods, but have not yet been disbursed to the seller’s bank account.

2. Sales Generation

When a customer buys your product, the sale amount is recorded in your Amazon payment account. However, the amount isn’t disbursed to your Amazon payments account right away.

3. Holding Period

Amazon holds the income for a seven-day period after the order is delivered. This offers buyers time to inspect or return their orders if there are any problems.

During this holding period, a portion of the funds may be placed in the Amazon account level reserve to cover potential liabilities such as returns, chargebacks, or A-to-Z guarantee claims.

4. Deductions

Amazon deducts various fees from your payments. Here are some of the fees that can be deducted from your Amazon monthly payments:

- Referral Fees. Amazon charges a referral fee on every item customers buy from you. This fee is a percentage of the total sale price, including any shipping or gift-wrapping charges. The percentage varies by product category but typically ranges from 6% to 45%.

- Fulfillment Fees (FBA Fees). For sellers using Fulfillment by Amazon, Amazon charges fees for storing, picking, packing, and shipping items. The size and weight of the items determine the amount of these fees. There are also additional fees for inventory storage, which vary by the time of year.

- Refund Administration Fees. When a customer returns a product, Amazon refunds the referral fee but retains a portion of it as a refund administration fee.

- Subscription Fees. Professional sellers pay a monthly subscription fee for their selling plan, charged $39.99 per month. Individual sellers, on the other hand, do not pay a subscription fee but are charged a per-item fee for each sale, which is $0.99 per item sold.

- Advertising Fees. If you use the platform’s advertising services, such as Amazon Ads, the costs associated with these services are deducted from your Amazon monthly payments.

If you think these deductions are many and steep, they may not be any different compared to the overhead costs of putting up your own online store. After all, building your own online store means having to pay for domain, platform fees, plug-ins, payment service provider fees, and others.

Here’s a basic comparison of Amazon and Shopify fees from Statys:

5. Payout

Does Amazon pay weekly? No. If not, then how often does Amazon pay? Amazon disburses payments to sellers every two weeks, specifically on the 1st and 16th day of each month.

The platform has an Amazon Pay Reserve Policy and applies a one-time, three-day hold policy on disbursements every time you add or change your bank account.

Once you capture a payment, the funds are placed into your Amazon Pay account. From there, they will be automatically transferred to your linked bank account during the next scheduled settlement period.

There are certain conditions to be eligible for Amazon monthly payments:

- Your account balance must be positive or zero, taking into account customer refunds and reserve.

- You have encoded in Seller Central valid information for your bank checking account based in the US.

6. Managing Payments

You can manage your account or change your Amazon payment method through the Seller Central dashboard. This platform allows you to track sales, monitor account reserves, and request manual disbursements if necessary.

Additionally, you can modify your Amazon payment plan or opt for faster options like Express Payout.

What is an Amazon Account Level Reserve?

An Amazon account level reserve is a portion of a seller’s funds that Amazon holds temporarily to cover potential liabilities.

This reserve is held back from the seller’s Amazon payment options as a precautionary measure. In doing so, you ensure that there are sufficient funds available to address any potential issues that might arise. For example, returns, chargebacks and A-to-Z guarantee claims.

The amount held in the reserve can vary based on several factors, including the following:

- Account Age. Newer accounts are often subject to higher reserve amounts as they lack a proven track record.

- Order Defect Rate (ODR). The ODR refers to the percentage of orders that receive negative feedback, A-to-Z Guarantee claims, or chargebacks. A higher ODR will lead Amazon to hold more funds in reserve to cover possible claims.

- Sales Volume. High sales volume can sometimes result in a higher reserve amount, particularly if there are corresponding increases in returns or disputes.

- Refunds and Returns. If a seller frequently issues refunds or handles returns, Amazon may hold back more funds to ensure there are sufficient resources to cover these expenses.

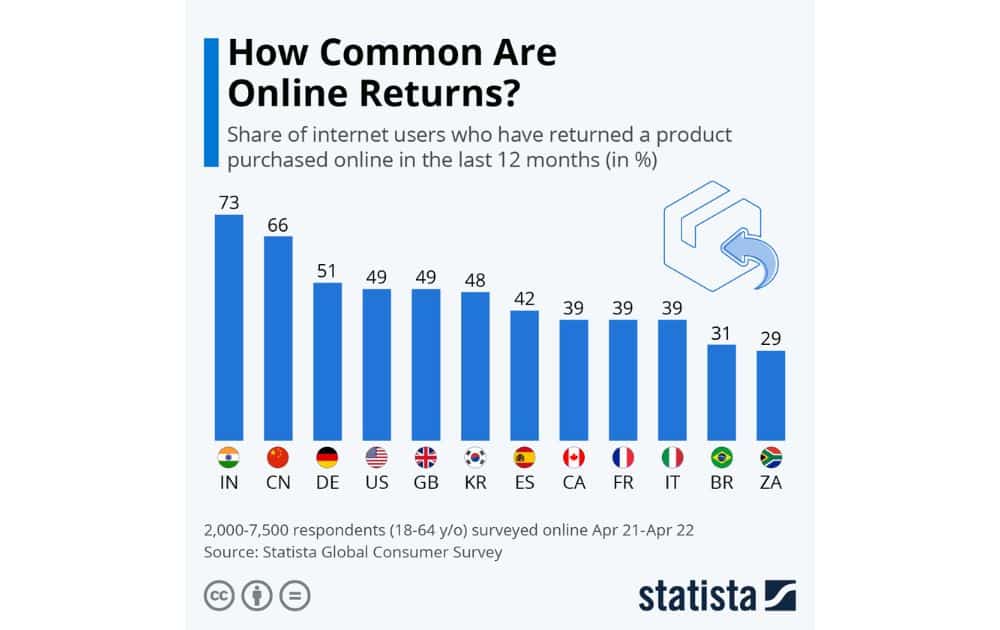

Data from Statista shows how common it is for shoppers all over the world to return items they bought online, with almost one in every two consumers in the US saying they’ve done so over the past year.

What is Amazon Express Payout?

If you find the twice-a-month Amazon online payment scheme, you may want to explore Express Payout. This program offers Amazon seller instant payment, ensuring that sellers on the platform can receive their payout within 24 hours and even on weekends.

Unlike default Amazon payment plans, this program is only open to qualified sellers who are already using Amazon Pay. To access the program, you need to sign up via Seller Central and use the same platform in case you want to opt out.

Amazon Monthly Payments | Tips to Optimize Cash Flow

Here are a few tips to optimize cash flow in the context of Amazon monthly payments:

- Ensure your account balance is always positive or zero to receive a timely Amazon account payment every settlement period.

- Take advantage of the detailed financial reports available in Seller Central. These reports can help you track your sales, fees, and other financial metrics, enabling you to forecast future cash flow accurately.

- Manage your inventory efficiently to avoid buying too much or too little stocks. Keeping the right amount of inventory ensures that you can meet customer demand without tying up too much capital in unsold stock.

- Consider enrolling in Amazon Express Payout to receive your earnings within 24 hours to improve your cash flow, especially during peak sales periods.

- Seek help from Amazon consulting experts like AMZ Advisers to ensure that you’re not blindly managing your business.

The Lowdown

Navigating the Amazon monthly payment process can be tricky at first. However, mastering it can help ensure that you have the needed funds to maintain operations, invest in growth opportunities, and achieve long-term success.

Author